Governance

Corporate Governance

Basic approach

The Aichi Steel Group believes in the importance of realizing a sustainable society through business activities in order to achieve sustainable growth and improve medium- to long-term corporate value. Based on this belief, we work to enhance corporate governance so that we can manage our businesses with a high level of fairness, transparency, and efficiency in accordance with Our Vision, and build strong relationships with our shareholders, customers, and all other stakeholders.

Initiatives for enhancing corporate governance

We are working to enhance corporate governance with the understanding that addressing management issues with a sense of urgency, while anticipating coming changes, is necessary for sustainably improving corporate value even in a dramatically changing business environment.

We implement all principles of the Corporate Governance Code, which was revised in June 2021, and make disclosures in the Corporate Governance Report, including sustainability initiatives and constructive dialogue with shareholders and investors. We also conduct management in a way that improves return on capital, including strengthening our intellectual and human capital and reviewing our portfolio.

Changes in the corporate governance structures

Corporate Governance Structures

Aichi Steel uses an Audit & Supervisory Board member system, with a General Meeting of Shareholders, Board of Directors, Audit & Supervisory Board, and accounting auditors, to ensure the transparency and health of management. We also use a managing executive officer and executive officer system to reduce the number of directors, and improve the efficiency and speed of business execution. We enhance the function and improve the quality of the Board of Directors by ensuring at least one third of directors are independent outside directors. The Officer Remuneration and Nomination Committee is in charge of nomination and remuneration of directors and managing executive officers. It helps to improve independence, objectivity, and transparency by considering and discussing these matters before consulting the Board of Directors.

To conduct our business, we have established a structure comprising in-house companies (four virtual companies built around our main businesses), a Corporate Office (four headquarters built around functions that support our business), and directly reporting divisions (management functions for safety, quality, auditing, and production in particular). Managing executive officers fulfill the role of chief executive officer of each in-house company and headquarters as presidents and general managers respectively, and support the Aichi Steel president from a companywide perspective.

Board of Directors

The Board of Directors makes decisions concerning legal matters, and important matters for the management of Aichi Steel, and supervises business execution. Having one or more meetings a month, it comprises ten members in total; six directors (including two outside directors), two inside Audit & Supervisory Board members, and two outside Audit & Supervisory Board members. The two outside directors selected as independent officers meet the independence criteria set by securities exchanges. We have created support structures that enable our outside directors to adequately fulfill their management advisory and supervisory functions.

Main agenda items in FY2022 for the Board of Directors

| Topics | Main agenda items |

|---|---|

| Management and business strategy |

|

| Governance |

|

| Other |

|

Board of Directors effectiveness evaluation

We evaluate the effectiveness of the Board of Directors every year to maintain and improve the effectiveness of corporate governance. We specifically interview and survey all members of the Board of Directors, analyze and evaluate their performance, and report effectiveness-related results, issues, and responses to the Board of Directors.

Main issues and responses

| Issue (1) |

|

|---|---|

| Response |

|

| Issue (2) |

|

| Response |

|

Support structures for outside officers

To eliminate differences in access to information compared to internal officers, and to maximize their performance, we give outside officers briefings on agenda items before meetings, provide onsite inspections, and hold meetings on special topic reports to enable free and open discussion outside of meetings of the Board of Directors. In addition to members of the Board of Directors, presidents and general managers related to the special topics also attend the meetings, where they can all participate in more profound discussions that include medium- to long-term strategies.

Audit & Supervisory Board

Comprising four Audit & Supervisory Board members, which includes two outside Audit & Supervisory Board members, the Audit & Supervisory Board audits the execution of duties of directors and other officers, as well as business and financial performance. In addition to attending meetings of the Board of Directors and other important meetings, Audit & Supervisory Board members coordinate with accounting auditors and departments in charge of internal audits to provide oversight of management.

Officer Remuneration and Nomination Committee

We have established a voluntary Officer Remuneration and Nomination Committee as an advisory body to the Board of Directors on matters related to nomination and remuneration of directors, managing executive officers, and other officers. Comprising two independent outside directors and one inside director, the committee is chaired by an independent outside director to ensure objectivity and transparency.

Main agenda items for the Officer Remuneration and Nomination Committee

| Topics | Agenda items |

|---|---|

| Officer remuneration |

|

| Officer nomination |

|

Approach to balance and diversity among directors and Audit & Supervisory Board members

To enable accurate and prompt decision-making and appropriate risk management that delivers sustainable growth and improved medium- to long-term corporate value, our Board of Directors is composed of members with expertise in all business and function areas, and diverse knowledge, experience, and skills. We take particular care to appoint outside officers, with management experience at other companies, who are expected to supervise management at Aichi Steel.

Procedure for appointment of directors and Audit & Supervisory Board members

- The Officer Remuneration and Nomination Committee regularly and as required evaluates and carefully considers experience, knowledge, performance, and other factors, and then reports its nomination candidates to the Board of Directors.

- The Board of Directors makes tentative decisions on nomination candidates with reference to the reports of the Officer Remuneration and Nomination Committee, and then makes final decisions through discussions at the General Meeting of Shareholders, and after prior approval of the Audit & Supervisory Board in the case of nominations for members of the Audit & Supervisory Board.

Skill matrix for directors and managing executive officers

We have defined the experience and expertise that we will need to achieve Vision 2030, and created the following matrix of particular expectations of each person below.

- This is not meant to represent the only experience and expertise possessed by each person listed.

| Name | Positions in the Company | Corporate Management | Risk Management | Contribution to a Sustainable Global Environment (E) | Creation of a Prosperous Society through Business Reform (S) | Employee Happiness and Corporate Development (G) | Production & Quality | Sales & Procurement | Financial Affairs | Overseas | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Environment | Energy | Technology & Development | IT & Digital | Legal Affairs and Compliance | Human Resource Development and Diversity | ||||||||

| Takahiro Fujioka | Chairman and Director | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Naohide Goto | President and Director | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Motoshi Nakamura | Executive Vice President and Directo | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Koichi Yasui [Outside] [Independent] |

Director | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Yuko Arai [Outside] [Independent] |

Director | 〇 | 〇 | 〇 | 〇 | ||||||||

| Naoki Ishii | Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Toshio Ito | Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | ||||||||

| Kazuya Fukatsu | Managing Executive Officer | 〇 | 〇 | 〇 | |||||||||

| Kazuma Kihara | Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||

Officer Remuneration

Basic approach

- Remuneration for each director shall be in accordance with the roles and responsibilities required of him or her.

- Remuneration shall be consistent with Aichi Steel business strategies and shall encourage directors to work toward sustainable improvement of corporate value.

- Remuneration shall motivate officers to have an even greater sense of responsibility as a member of management and to promote management from the same perspective as shareholders.

- Remuneration shall be set at a level that takes into account the business environment, market trends, and payment levels of other companies.

- The remuneration system decision process shall be objective and highly transparent.

Decision processes

Aichi Steel established the Officer Remuneration and Nomination Committee, with the chair being an independent outside director and the majority of members also being independent outside directors, to ensure objectivity, fairness, and transparency in decisions such as remuneration for directors. The committee discusses director remuneration structures, levels, decision-making policies and procedures, and individual levels of remuneration based on the decision-making policies. Based on the results of those discussions, the Board of Directors determines policies for director remuneration, individual levels of remuneration, and other matters. From the perspective of maintaining independence, remuneration for outside directors is at a fixed rate.

Remuneration structure

Remuneration and other payments to directors and Audit & Supervisory Board members

| Officer classification | Total remuneration (million yen) |

Total remuneration by type (million yen) | Number of applicable officers (persons) | ||

|---|---|---|---|---|---|

| Monthly remuneration | Bonuses | Stock remuneration | |||

| Directors (excluding outside directors) | 237 | 189 | 24 | 24 | 5 |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members) | 73 | 73 | N/A | N/A | 2 |

| Outside officers | 36 | 36 | N/A | N/A | 4 |

-

- Performance-based remuneration includes bonus amounts determined by resolution at the meeting of the Board of Directors on May 16, 2023.

- Stock remuneration includes amounts related to restricted stock granted to directors (excluding outside directors) and expensed during the current fiscal year.

- The above includes one director who retired at the close of the 118th General Meeting of Shareholders held on June 22, 2022.

Cross Shareholdings

Basic approach

Maintaining and strengthening of trade and collaborative relationships with a range of companies are needed to ensure sustainable growth in a rapidly changing business environment. For this reason, Aichi Steel engages in cross holdings with other companies, but only if it deems them to be effective in improving corporate value from a medium- to long-term perspective in a comprehensive evaluation that considers its business strategy, future relationships with suppliers and affiliated companies, and other factors.

Verification of cross shareholding suitability

Each year, at a meeting of the Board of Directors, we make comprehensive verifications and assessments of the suitability of each cross shareholding based on quantitative factors, including whether dividends, business profits, and other figures exceed our weighted average cost of capital, as well as qualitative factors, including trading status and business-level collaborations. If a shareholding is determined to be unsuitable according to the verification, we decide on what course of action to take, including disposing of the shares.

Standard for exercising voting rights

Rather than applying uniform decisions from typical and short-term criteria, we make decisions on each agenda item separately. We consider them from various perspectives, including corporate value improvement and shareholder returns over the medium to long term, while fully respecting the management policy, business strategies, and other decisions of the companies in which we invest. When exercising our voting rights, we make comprehensive decisions on whether to approve agenda items after closely investigating factors such as business performance, governance, and capital policy that would represent a confiict of interest with us, or would change or dilute our shareholdings.

Changes in volume of cross shareholdings

Risk Management

Basic approach

Business environments are becoming increasingly diverse and are experiencing major changes, including climate change, resource depletion, tension in international affairs, large-scale disasters and spread of the pandemic, supply chain disruptions and other issues impacting business activities, and instability of society due to growing divides. These social and environmental challenges are having a severe impact on companies' value creation and business models. Such conditions have made risk management one of the most important challenges for business management, so Aichi Steel is working to minimize risks by both enriching and enhancing risk management. Specifically, we classify potential impacts on business management as either "risks"(matters yet to materialize) or "crises"(emergencies that have materialized). We then focus on preventive measures that eliminate risks before they become crises, and on prompt and accurate initial and recovery responses that minimize damage in the event of a crisis occurring.

Examples of specific initiatives

Twice a year, at the midpoint and at the end of the fiscal year, the Executive Committee discusses and approves the risk management progress review, annual policy, and approach going forward.

1. Reevaluation of major risks and consideration of countermeasures

After acquiring IATF 16949* certification in fiscal 2022, we took the opportunity to reevaluate our major risks, and to start verifying and improving the effectiveness of companywide business continuity plans as measures to take if the risks materialize.

- An international standard for quality management systems specialized for the automotive industry and used by many of the world's automakers as their global procurement standard for automotive parts

2. Disaster management

(1) Awareness raising

We revised the content of our Guide to Emergency Disaster Management and re-familiarized all employees with the basic actions to take in the event of an earthquake or other disaster.

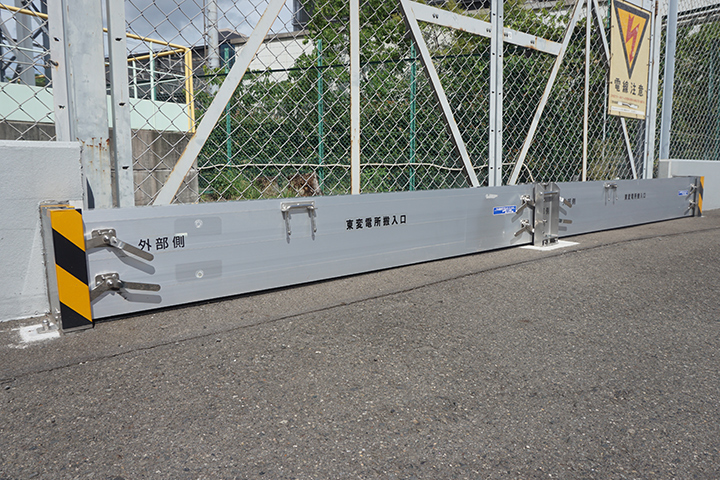

(2) Measures against heavy rains and storm surges

As a measure against flood damage from heavy rains, we installed new water barriers at service entrances and other places within the Chita Plant. We are also working on measures against storm surges that accompany large typhoons, and we are conducting internal investigations toward incorporating those measures into our next Medium-term Management Plan.

(3) Emergency drills

We conduct companywide emergency drills twice a year. In fiscal 2022, we conducted training for the first time in collaboration with the Tokai City Fire Department, from initial efforts to extinguish a fire to use of fire hoses. To improve crisis response and judgment capabilities in emergencies, we also conducted a new role-playing and map-based simulation as a practical training for an earthquake in the Nankai Trough. By keeping the scenario secret until the training, we were able to raise awareness of disasters while helping participants to understand the importance of appropriate and prompt responses in a constantly changing situation.

Strengthening of risk responses

We are working to strengthen risk management to enable rapid responses in an increasingly complex business environment that includes a heightening of geopolitical risks and increasingly problematic cyberattacks and climate change. In addition to reverifying the effectiveness of our countermeasures to individual risks that have materialized, we are gathering more information than ever, on a global scale, about risks that could materialize in the future (potential risks). While risk responses were previously conducted mainly by our functional divisions, we intend to strengthen collaboration with the business divisions going forward as we work to develop mechanisms for better identifying risks and taking appropriate action. By continuing to strengthen our risk response capabilities and reduce loss when risks materialize, we are striving to sustainably improve corporate value.

Information Security

Basic approach

In addition to holding important information assets, including entrusted customer and supplier information and proprietary trade secrets, Aichi Steel has been adopting remote operations and networking plant equipment over recent years. We are implementing information security measures in recognition that stability of product supply is a company responsibility and an important management issue. We are doing this by protecting information assets from cyberattacks and other threats, data leaks, and other issues that have been increasing on a yearly basis, and by maintaining continuity of normal business activities.

Promotion structures

We have established Groupwide structures, based on the All Toyota Security Guidelines (ATSG) shared within the Toyota Group and led by the Chief Information Security Officer (CISO), for maintaining and improving information security on a systematic and ongoing basis. We are also working to ensure the same level of security can be maintained on a global level.

The CISO oversees all information security and information asset protection for the Group as a whole, while the Security Management, Office Automation and Business System Security, and Plant System Security organizations are in charge of planning, promotion, auditing, and support. Twice a year, the Board of Directors receives progress, issue, and other reports from the CISO as part of its supervisory function.

Examples of specific initiatives

Security inspections and audits based on the ATSG

We continually inspect the status of information security measures across the Group, and continually maintain and improve our information security. This fiscal year, we are working with Group companies to strengthen measures to comply with version 8.1 of the ATSG.

Email-based cyberattacks

Cyberattacks are becoming increasingly complex and sophisticated these days, and with many of them coming via email viruses, there is an urgent need to strengthen countermeasures. We are also working to prevent such cyber incidents through technical measures, including adoption of defense systems against suspicious emails from outside, and through people-centered measures, including employee training and education on targeted email attacks.

Security incident training

We conduct security incident training to minimize damage and impacts on our operations in the event of a security incident occurring. We start by formulating specific risk scenarios so that participants can experience an actual incident in chronological order. We can then verify and improve the effectiveness of handling in the event of a cyberattack, procedures for early recovery of systems, and a division of roles that enables our operations to continue even without the usual systems. In this way, we are improving our systematic incident response capabilities and our ability to handle unexpected events.

Compliance

Basic approach

Based on the belief that commitment to compliance underpins a company's continued existence and is the foundation for its corporate activities, Aichi Steel established the Aichi Steel Group Action Guidelines and it ensures awareness of the guidelines among all officers and employees. In addition to laws and regulations, we also comply with social norms and decency, and internal company rules. To this end, we always strive to raise awareness of compliance, to prevent misconduct, and to fulfill the social responsibilities of the company.

Promotion structures

To maintain and strengthen compliance levels across the Group as a whole, we report on progress reviews and initiative policies in the Business Promotion Councils, which is chaired by the president. This system enables us to share, with all employees, the determined initiative policies and activity plans via the persons in charge of compliance in each division and domestic subsidiary, and to reflect them in activities being conducted in each workplace. Group companies are working to ensure compliance through establishment of promotion structures in line with their own size and circumstances. The Compliance Liaison Meeting also holds four regular meetings each year to share things like revisions to laws and regulations and points of concern regarding legal compliance, and to promote Groupwide compliance activities.

Examples of specific initiatives

Education and awareness-raising activities

The persons in charge of compliance in each division and domestic subsidiary attend meetings of the Compliance Liaison Meeting and lead compliance activities in each workplace. A range of awareness-raising activities are also conducted in each workplace through Compliance Close Call activities (inspections of events in daily operations that could lead to violations of laws and regulations). In addition, compliance education is conducted for people at all levels in accordance with the roles that they have to play. From fiscal 2021, in addition to education on what not to do, which has been the norm until now, we have been providing ethical compliance education, through videos and other methods, to encourage employees to act as members of the Aichi Steel Group should.

Awareness surveys

We conduct compliance surveys of all employees once a year to understand the current state of compliance and any related issues. In fiscal 2022, over 98% of employees responded to the survey. By quantifying and visualizing such things as compliance awareness and activity penetration within the company, we are able to identify priority issues and implement effective improvements. Providing relevant feedback to divisions through the Compliance Liaison Meeting and other channels is also helping us to improve the level of workplace activities.

Aichi Steel Groupwide compliance activities

In fiscal 2022, we started a program to support self-driven improvement of compliance levels at Group companies. During the first year, we conducted separate interviews with every company in the Group to understand the compliance status of each company. During fiscal 2023, we have been following up with the companies to ensure they have achieved the basics for legal compliance.

Whistle-blowing system

We have established an internal whistle-blowing system to promote early detection of violations of laws and regulations, and misconduct, within the company and to self-govern through appropriate measures. Called the Aichi Steel Compliance Hotline, we have established three contact points operated separately by external legal representatives, internal Audit & Supervisory Board members, and the General Affairs Division. Information on whistle-blowing incidents is shared among the three contact points and appropriate measures are taken while fully considering privacy protections and ensuring no disadvantageous treatment.